The world of Crypto-Currencies is growing into what non-tech investors would call a ‘ technological maelstrom’. With over 2082 crypto-currency coin/tokens listed on CoinMarketCap.com, it’s no wonder why new investors are struggling to even begin understanding the endless jargon pit that the crypto-universe has turned into. Let's try and break crypto and the associated passive income down into their most basic forms.

In it’s simplest form, crypto coins/tokens can be broken into 3 categories, Proof-of-work (POW) coin, Proof-of-Stake (POS) coins, and Utility tokens. Utility tokens will not be touched on today as they require their own blog post.

Proof-of-Work

Now before we go ahead, if you do not understand what a blockchain is or how transactions are stored in groups (blocks) on a decentralized ledger, then I recommend finish reading this blog post and then googling ‘what is blockchain’. Items mentioned below may make a bit more sense after understanding what a blockchain is, but we’ll keep it nice and simple for now.

Let's start with the biggest of all crypto’s, Bitcoin. Most of the public have heard of Bitcoin before and how much electricity is used to sustain the Bitcoin decentralized network. Bitcoin is a POW coin, meaning that the network is maintained and transactions verified via the use of computers solving complex algorithms. The computers are in turn ‘working’ to verify/prove the existence of millions of transactions for each new block on the blockchain, hence the name Proof-of-Work. When a computer is the first to confirm a block of transactions via the solving of algorithms, it is rewarded with an amount of Bitcoin (or whatever coin the computer is solving for).

Proof-of-Stake

Here at StakeSafe, we have focused our expertise and business around POS coins. Proof-of-Stake coins consume significantly less energy to maintain the network and verify transactions compared to POW coins. POS coins work by a very simple formula (let's just forget about the back-end coding and algorithms for a minute): everyone's stakes their coins to verify everyone else’s transactions. Let's break the aforementioned sentence down.

To help maintain the network, owners of the coins for each specific coin network must hold their personal coins within a digital wallet. Said wallet for most coins must be A) opened, B) unlocked, C) have synced with the network and downloaded the latest block on the blockchain and D) contain coins.

The wallets, in turn, take part in a weighted voting system whereby the wallets with the most coins hold the most chances of voting and vice versa for the wallets with little sums of the specific coin. For each block of transactions that is created on the digital ledger, all wallets throw in their vote. The wallet must also ‘stake’ a percentage of their personal coins on their vote to ensure as a minimum voting requirement so that ‘fake’ voting doesn't occur.

When every wallet has voted, the network chooses a winner to verify the transactions. As said previously, the more coins you stake, the higher the chance you have to win. The ingenious idea behind POS at this point is that if the transactions are said to be ‘real and true’ by the selected winning wallet but the rest of the voting wallets disagree and conclude that the transactions are fake and malicious, then the winning wallet will lose the winning vote and also their staked amount of coins.

Don't be afraid of losing your coins though if you keep them in a POS wallet. The odds of losing your staked coins at present are slim to none. The specific coins in-house security features provide quite the resistance against malicious personnel trying to attempt to ‘fake’ transactions and steal coins.

If the winning wallet verifies the transactions and the network agrees, the wallet is rewarded with a sum of coins on the same network as the coins staked.

Passive Income

Ahh now for the good part, Passive Income.

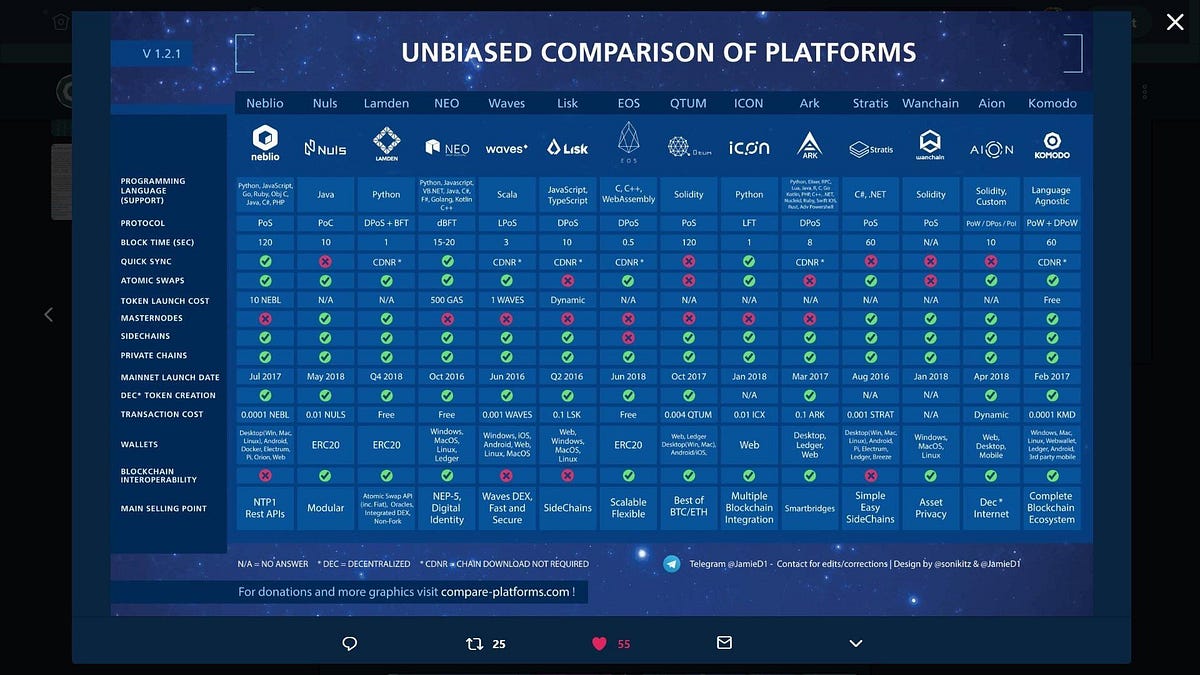

There are a lot of POS coins out there, some with higher ROI (Return on Investment), some with lower. Below is a table illustrating the top POS coins in the industry along.

Neblio, for example, has a fixed ROI of 10%. This means that if a wallet has 1000 coins stored in it, then after 1 year that same wallet will have 1100 coins in it (Not including gained network fees). How easy right! That's better then your banks saving account by far.

If you feel a more thorough POS explanation is required, click on the following link: https://www.cryptocompare.com/mining/guides/what-is-proof-of-stake/

If you wish to start staking your crypto or wish to ask questions about all things crypto related, join StakSafes community Discord channel: https://discord.gg/KaFAzx

If you're looking for a secure, pre-configured wallet to stake your crypto on and start earning passive income, purchase a stand-alone wallet from StakeSafe: www.stakesafe.com.au.